CEO and C-Suite ESG Priorities for 2025

The environmental, social & governance (ESG) landscape will grow more complex in 2025, with businesses facing increasing pressure related to climate risks, regulatory changes, and shifting societal expectations. Based on The Conference Board® C-Suite Outlook 2025: Seizing the Future, a comprehensive survey of global business leaders, this report highlights the key ESG priorities of CEOs and C-Suite executives, with a primary focus on US CEOs and additional insights from European and global perspectives— providing a strategic road map for the year ahead.

Key Insights

- US CEOs rank climate risk and sustainability as the top-two external ESG factors likely to impact their business in 2025.

- ESG regulatory complexity is increasing, but US CEOs anticipate less significant business impact from regulations and disclosures compared to their international counterparts.

- Anti-ESG sentiment ranks fourth among external ESG challenges for US CEOs in 2025 but is absent from the top five for CEOs globally or in Europe, reflecting heightened political polarization and scrutiny in the US.

- US CEOs prioritize climate resilience and water management as their top environmental concerns for 2025, reflecting perceived risks from extreme weather and water scarcity.

- Economic opportunity and education lead US and global CEO social priorities, as diversity, equity & inclusion (DEI) backlash shifts some focus away from gender and racial equality.

External ESG Factors that will Impact on Businesses in 2025: Climate Events, Regulations, Backlash lead for US CEOs

Sustainability and climate events: A global priority with distinct US focus

Climate events is the top external ESG-related factor expected to impact on corporate America in 2025. In 2024, the US experienced numerous extreme weather and climate disasters, with at least 27 of them causing losses exceeding $1 billion each. This follows a record 28 such disasters in 2023, and tragic wildfires in Los Angeles in January 2025 underscore that this trend is likely to continue. Business leaders are increasingly viewing climate not just as an environmental challenge but as a material risk requiring proactive management to safeguard long-term competitiveness and value creation: in 2024, 84% of S&P 500 companies and 64% of Russell 3000 companies reported climate change as a risk factor, up significantly from 67% and 30% in 2021. [1]

While sustainability ranks second for US CEOs as a long-term objective tied to strategic resilience and competitiveness, the immediate and tangible impacts of climate events demand more urgent action. This contrasts with Europe, where sustainability leads due to strong regulatory drivers like the Corporate Sustainability Reporting Directive [2] (CSRD) and broader societal alignment on climate goals. Globally, both climate events and sustainability agendas are top of mind for CEOs and executives, as well as board members. Advances in energy technology ranks third for US CEOs due to its critical role in addressing climate risks, reducing costs, and enhancing energy security.

Navigating ESG regulatory complexity: A growing pressure

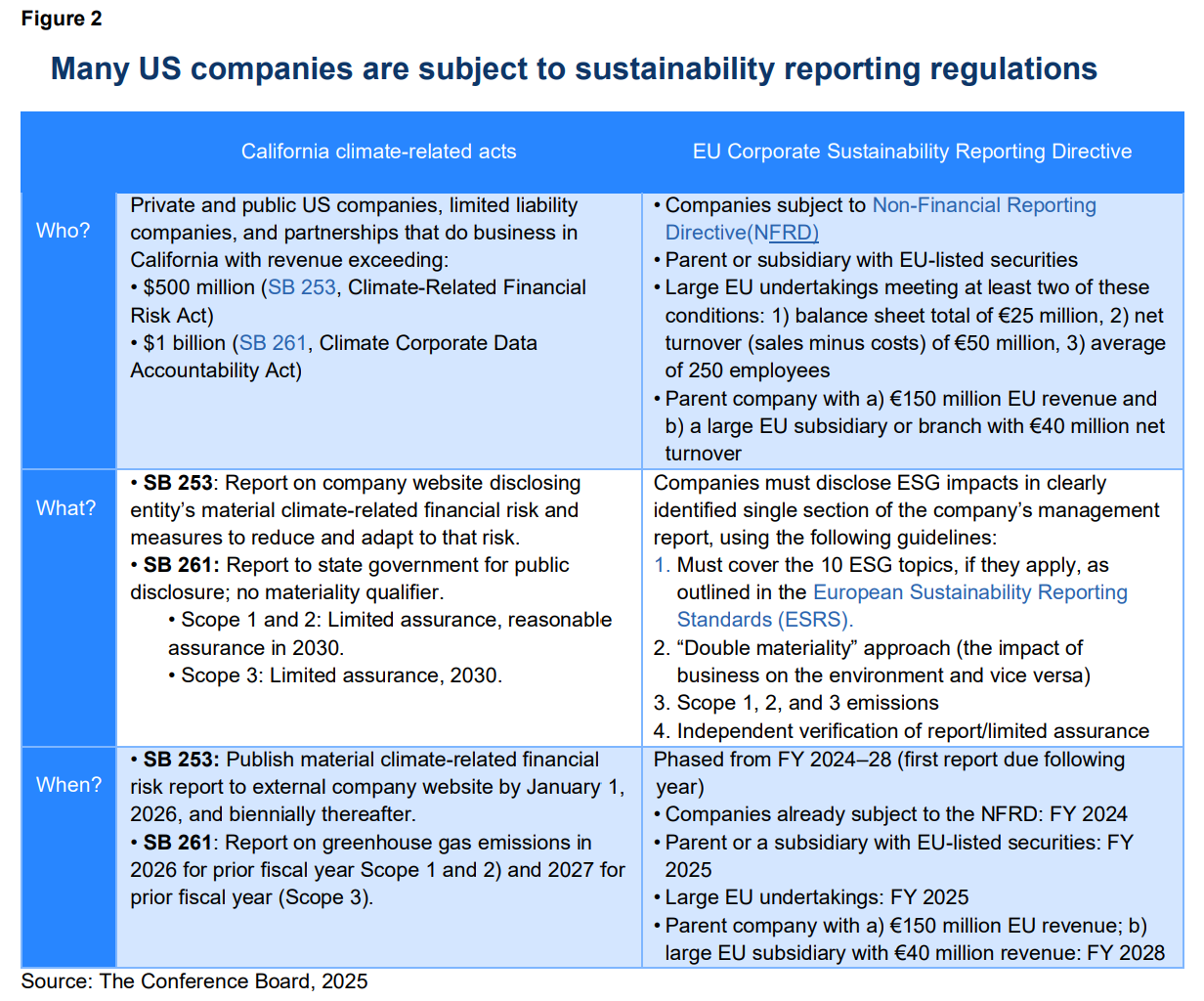

ESG regulations and disclosures rank fifth among external ESG issues for US CEOs in 2025 and third for US executives, reflecting increasing pressures from state-level initiatives like California’s sweeping climate disclosure laws [3] and growing investor demands for transparency. However, under the new administration, the Security and Exchange Commission’s proposed enhanced climate disclosure rules—which would have required all publicly listed companies to report on material climate risks, climate-related targets, and Scope 1 and Scope 2 emissions— are unlikely to proceed, leaving the US sustainability reporting landscape uneven. This fragmentation will complicate compliance, as many larger firms must navigate overlapping obligations from California’s laws and international frameworks such as Europe’s CSRD (Figure 2).

Globally, the shift from voluntary to mandatory sustainability reporting is accelerating. The CSRD is setting the benchmark for detailed disclosure standards and many jurisdictions are adopting or aligning with the International Sustainability Standards Board [4] framework, advancing a broader move toward global consistency. While these developments position sustainability reporting as a global priority, US executives rank disclosure concerns lower than their European and international counterparts, where comprehensive mandates like the CSRD have made ESG compliance a central focus. Notably, CEOs globally in the manufacturing industry also cite regulations as the top factor likely to impact on their business in 2025, which may reflect the sector’s large environmental footprint, complex supply chains, and reliance on capital and consumer trust.

Anti-ESG sentiment: A US-specific risk

Anti-ESG sentiment is not ranked among the top-five external ESG-related issues globally or in Europe for 2025. However, it notably ranks fourth for US CEOs and executives, ahead of even regulatory concerns. This highlights the growing momentum of ESG backlash in the US since 2022, fueled by concerns over perceived overreach of ESG initiatives, skepticism about their financial materiality, and broader debates on the role of corporations in addressing social and environmental issues. High-profile developments, such as state-level restrictions on ESGrelated investments and critiques of corporate ESG policies, have further polarized discourse.

Looking ahead, anti-ESG sentiment is likely to remain a significant force shaping US corporate strategy, particularly amid a shifting political and legal environment. The anticipated rollback of federal climate disclosure rules, coupled with potential state-level restrictions on ESG-aligned investments and litigation challenging the link between ESG and fiduciary duty, will further complicate the landscape. To navigate these pressures, companies should adopt nuanced communication strategies that emphasize the alignment of ESG initiatives with financial performance and risk management, while addressing diverse stakeholder expectations. Additionally, business leaders can focus on measuring and clearly demonstrating the tangible return on investment from sustainability and ESG initiatives.

C-Suite Environmental Priorities for 2025: Climate Resilience and Water are top of mind for US CEOs

Renewable energy and carbon neutrality: Universal goals, divergent emphasis

Renewable energy, carbon neutrality, and the energy transition are global environmental priorities for surveyed CEOs, executives, and board members, reflecting a collective recognition among business leaders of the urgent need to address climate change and its associated risks. However, US CEOs place slightly less emphasis on these goals compared to their European counterparts. While the continent’s stringent decarbonization mandates—such as the European Green Deal [5] and the CSRD—create immediate pressure to act, US federal climate policies are less consistent, with significant variation at the state level. Nevertheless, recent federal legislation has spurred substantial investment in renewable energy and clean technologies, supported by declining costs and energy security considerations, sustaining near-term momentum for renewables.

In 2025, the priorities of the new US administration will likely shift toward increased fossil fuel production and deregulation, potentially slowing progress toward national carbon neutrality goals. However, state-level leadership is expected to persist, and many leading US companies will remain aligned with international frameworks like the CSRD and investor-driven decarbonization demands. Notably, nearly 90% of the largest US public companies have already set publicly disclosed climate targets, such as achieving net zero by 2050 (Figure 4).

Climate resilience and water: Key US priorities

Climate resilience and water management rank as the top environmental priorities for US CEOs, above renewable energy and carbon neutrality, reflecting the nation’s regional challenges and immediate operational risks. To address challenges posed by extreme weather events and climate disasters, companies are prioritizing climate resilience to protect assets and meet stakeholder expectations for proactive risk management, with rising costs from climaterelated property damage and insurance premiums further driving the urgency. In 2025, US companies are likely to prioritize enhancing infrastructure resilience and further integrating climate risk into strategic planning.

Water management climbed to second place among US CEOs’ priorities for 2025—up from fifth in 2024—as water scarcity increasingly poses operational and reputational risks, particularly in arid regions such as the Southwest. Growing scrutiny of corporate water use, coupled with heightened consumer and investor focus on water stewardship, amplifies these concerns. Key water-related priorities for 2025 are expected to include improving water efficiency and recycling, restoring watersheds, and enhancing disclosure practices. Notably, US public companies have already made progress in these areas, with median total water consumption declining since 2022.

Circular economy: A growing focus with European leadership

In the US, waste and the circular economy—the reuse, repair, refurbishment, and recycling of materials and products—ranks fifth among environmental priorities for CEOs. In contrast, European CEOs rank it second and it is the third-highest priority globally, driven by strong cultural alignment and robust regulatory frameworks such as the EU’s Circular Economy Action Plan. [6]

While the circular economy is an emerging priority in the US, progress is evident as more companies adopt waste reduction strategies and recognize the operational and economic benefits of resource efficiency. Global supply chain demands and international frameworks like Europe’s CSRD are likely to influence greater US alignment. Notably, the share of US public companies with formal waste reduction policies has grown significantly since 2021, alongside a gradual decrease in median total waste among Russell 3000 firms. [7]

C-Suite Social Priorities for 2025: Economic Opportunity and Education are Prominent Globally and in the US

Economic opportunity and education: Universally recognized priorities

Economic opportunity and education are the top-two social priorities for CEOs in the US and globally, continuing a trend from previous years and reflecting their pivotal role in workforce development and economic growth. Persistent workforce gaps across industries have intensified the focus on recruiting, retaining, and reskilling employees to meet rapidly evolving economic demands. In 2025, companies should anticipate greater emphasis on partnerships with educational institutions to develop tailored training programs, apprenticeships, and certifications—particularly in high-demand fields like STEM, digital literacy, and advanced manufacturing.

Business leaders can also expand efforts to enhance economic opportunity by investing in workforce development and fostering job creation, especially in underserved and economically distressed communities. This includes scaling supplier diversity programs, funding local infrastructure projects, and building community partnerships that improve access to quality jobs and career pathways.

Labor and working conditions: Less urgent in the US than Europe

Labor and working conditions rank as a top social priority for European CEOs, driven by robust EU regulations like the CSRD and Corporate Sustainability Due Diligence Directive [8] (CSDDD). These rules mandate disclosures on labor practices, supply chain risks, and human rights impacts, pushing companies to ensure fair wages, safe conditions, and ethical practices. Cultural factors, including strong trade unions and a societal focus on worker welfare in many European countries, further elevate the importance of labor issues.

Labor conditions rank lower in the US, reflecting a less stringent federal regulatory landscape. While states like California have introduced wage and workplace laws, there is no framework comparable to Europe’s directives. US CEOs instead tend to prioritize economic opportunity and education, which align with immediate market needs. However, rising consumer and investor expectations for fair pay and working conditions, both domestically and globally, are encouraging US firms to improve transparency and accountability. Internationally, compliance with European regulations like the CSDDD, which applies to non-EU firms with significant European operations, adds complexity for US companies managing global supply chains.

Gender and racial equality: Shifting emphasis and regional variations

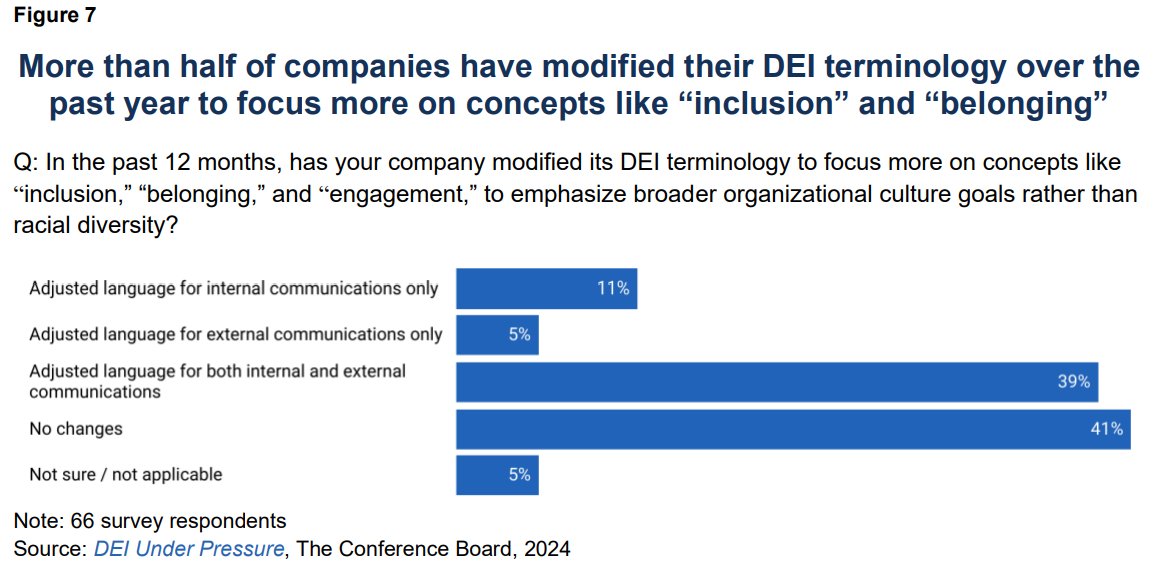

In the US, gender equality ranks fourth among CEO social priorities for 2025, down from third in 2024, with its continued high rating underscoring its enduring importance. Companies remain focused on increasing women’s representation in leadership, achieving pay equity, and breaking systemic barriers to advancement. However, racial and ethnic equality has dropped from fourth to sixth, which may reflect a more challenging environment for corporate DEI efforts, especially when addressing specific racial and ethnic groups. Legal challenges to affirmative action, state-level restrictions on DEI programs, and the rolling back of diversity-related disclosure rules have heightened scrutiny and increased reputational and legal risks—a trend likely to persist under the new administration. Recent research from The Conference Board indicates that most firms have adjusted DEI messaging and terminology in the past year to mitigate legal and political risks (Figure 7), and this trend will likely continue in 2025.

Globally, gender equality remains a consistent CEO priority, driven by broad societal consensus and reinforced in Europe by measures like gender quotas for corporate boards and pay transparency laws. In contrast, racial and ethnic diversity ranks lower, reflecting less diverse demographics and differing societal dynamics in many countries. These regional variations underscore the importance of tailoring DEI strategies to align with cultural and regulatory contexts.

1 Data on climate risk disclosure by US public companies are sourced from TCB Benchmarking data on corporate environmental practices, powered by ESGAUGE. (go back)

2 The EU’s Corporate Sustainability Reporting Directive (CSRD), which took effect in January 2023 with the first reports due for certain EU entities in 2025 reporting 2024 data, requires companies operating within the EU, including those from the US with relevant subsidiaries, to provide comprehensive sustainability disclosures and limited assurance reports pursuant to the new European Sustainability Reporting Standards. These standards, drafted by the European Financial Reporting Advisory Group, require reporting based on the principle of “double materiality,” covering the impact of sustainability issues on business and vice versa. (go back)

3 In 2023, California enacted two laws mandating both public and private companies operating in the state report greenhouse gas emissions and climate-related financial risks. The Climate Corporate Data Accountability Act (SB 253) requires entities with over $1 billion in annual revenues to report their Scope 1 and Scope 2 emissions from 2026, and Scope 3 emissions from 2027, with a limited assurance report. A second law, Greenhouse Gases: Climate-Related Financial Risk (SB 261) mandates entities with revenues over $500 million disclose their climate-related financial risks on their websites by 2026, detailing adaptation and mitigation strategies. Also in 2023, California enacted the Voluntary Carbon Market Disclosures Act (AB 1305), which requires disclosure about data and claims by businesses operating in California that market or sell voluntary carbon offsets or make claims regarding the achievement of net-zero emissions, carbon neutral status about the company or a product, or significant carbon emissions reductions. The compliance deadline for AB 1305 was January 1, 2024, but the bill author’s intended date was January 1, 2025. (go back)

4 The International Sustainability Standards Board (ISSB) aims to establish a global baseline for sustainability reporting through its IFRS Sustainability Disclosure Standards. These standards are designed to enhance consistency and comparability in ESG disclosures, focusing initially on climate-related risks and opportunities. Adoption is gaining traction internationally, with jurisdictions like the UK, Canada, and Japan integrating ISSB standards into their regulatory frameworks; while others, including the EU, align them with existing frameworks such as CSRD. (go back)

5 The European Green Deal is the EU’s overarching strategy to achieve climate neutrality by 2050, with interim goals such as a 55% reduction in greenhouse gas emissions by 2030. It encompasses a wide range of initiatives, including the EU Taxonomy for sustainable finance, the CSRD, and the Carbon Border Adjustment Mechanism, all aimed at integrating sustainability into policy and business practices. The Green Deal sets strict regulatory and financial incentives, driving decarbonization, circular economy efforts, and biodiversity protection. (go back)

6 The EU Circular Economy Action Plan is a cornerstone of the European Green Deal, aiming to transition the EU to a sustainable, low-waste economy by decoupling growth from resource use. It prioritizes design for sustainability, the reduction of waste, and reuse and recycling across key sectors such as electronics, textiles, construction, and packaging. Key initiatives include mandatory requirements for product durability, repairability, and recyclability, as well as stricter rules on waste management and extended producer responsibility. (go back)

7 Data on waste policy and total waste disclosure by US public companies are sourced from TCB Benchmarking portal on corporate environmental practices, powered by ESGAUGE. (go back)

8 The EU Corporate Sustainability Due Diligence Directive (CSDDD) introduces stringent requirements for companies to identify, prevent, and address adverse human rights and environmental impacts across their value chains. Applicable to large EU-based firms and significant non-EU entities operating within the EU, the directive mandates due diligence processes, accountability for supply chain practices, and alignment with Paris Agreement climate goals. The CSDDD represents a major step in embedding sustainability into corporate governance, but its extraterritorial scope and implementation challenges raise compliance complexities for global businesses. (go back)

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release