IPQS Launches Revolutionary Email Verification Database to Strengthen Fraud Prevention

Introducing a new product to combat fraud by detecting risky email credentials–while eliminating latency and enhancing data residency compliance.

LAS VEGAS, NV, UNITED STATES, May 15, 2025 /EINPresswire.com/ -- IPQS, a global leader in fraud prevention and risk intelligence, is proud to announce the launch of its IPQS Email Verification Database. This database is the first of its kind, enabling businesses to validate email addresses at scale. It reduces the need for external API calls for every fraud check, and makes it easier to comply with data privacy regulations.

The IPQS Email Verification Database enables businesses to identify fraudulent, disposable, or suspicious emails with unparalleled accuracy by tapping into IPQS’s vast repository of email reputation data. By analyzing factors such as email age, domain reputation, and historical fraud associations, companies can significantly enhance fraud detection while improving customer trust. Additionally, businesses can maintain better email hygiene by filtering out invalid or risky email addresses, improving deliverability rates and sender reputation.

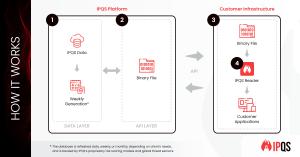

Email validation is essential for multi-layered fraud detection. However, companies may be wary of adding latency from additional risk checks or face regulatory restrictions on sharing customer data. Now, businesses can leverage email risk data in a locally hosted file. This data is delivered in a binary format which ensures fast downloads, alongside a reader that supports seamless integration into your applications and across all major programming languages.

The Next Generation of Email Intelligence

With billions of emails in its database, and growing daily, IPQS provides businesses with the most comprehensive access to granular email risk intelligence. This enables organizations to detect high-risk users, block fraudulent account registrations, and prevent payment fraud at scale. Delivered securely via an API, the database is updated on a daily, weekly, or monthly basis, depending on business requirements.

On-Premise Deployment: Eliminates API latency by processing email validation and fraud detection directly within company infrastructure.

Lightweight Design: Delivered in a proprietary binary format with a reader, enabling fast downloads and seamless integration.

Regulatory Compliance: Supports data residency regulatory requirements for companies that cannot share customer data with third-party providers.

Unmatched Data Accuracy: IPQS has been building its proprietary datasets for over a decade, providing industry-leading accuracy in detecting compromised and high-risk email addresses.

Email List Hygiene: Improves deliverability rates for email communication by helping to maintain a clean, verified contact list.

A Revolution in Fraud Prevention

Regarding this innovation’s impact, IPQS CEO Dennis Weiss said: “Fraud prevention is only as good as the data behind it. With the IPQS Email Verification Database, businesses can tap into the freshest, most comprehensive email risk intelligence—processed instantly, on their own infrastructure. This launch sets a new standard for speed, accuracy, and compliance in fraud detection.”

The IPQS Email Verification Database is available now and integrates seamlessly with IPQS’s full suite of fraud prevention tools, including IP address, device, phone, and cyber risk assessments. Businesses can schedule a demo or learn more by visiting www.ipqs.com/demo.

Lizzie Clitheroe

IPQS

+1 800-713-2618

lizzie@ipqs.com

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

IPQS Email Verification Database Video

Distribution channels: Banking, Finance & Investment Industry, Consumer Goods, IT Industry, Media, Advertising & PR, Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release